What USAA is doing to prevail in its fiercely competitive environment by delivering an excellent customer and digital experience

Authors: Juergen Roesger, Philipp Kramberg

10 minutes reading time

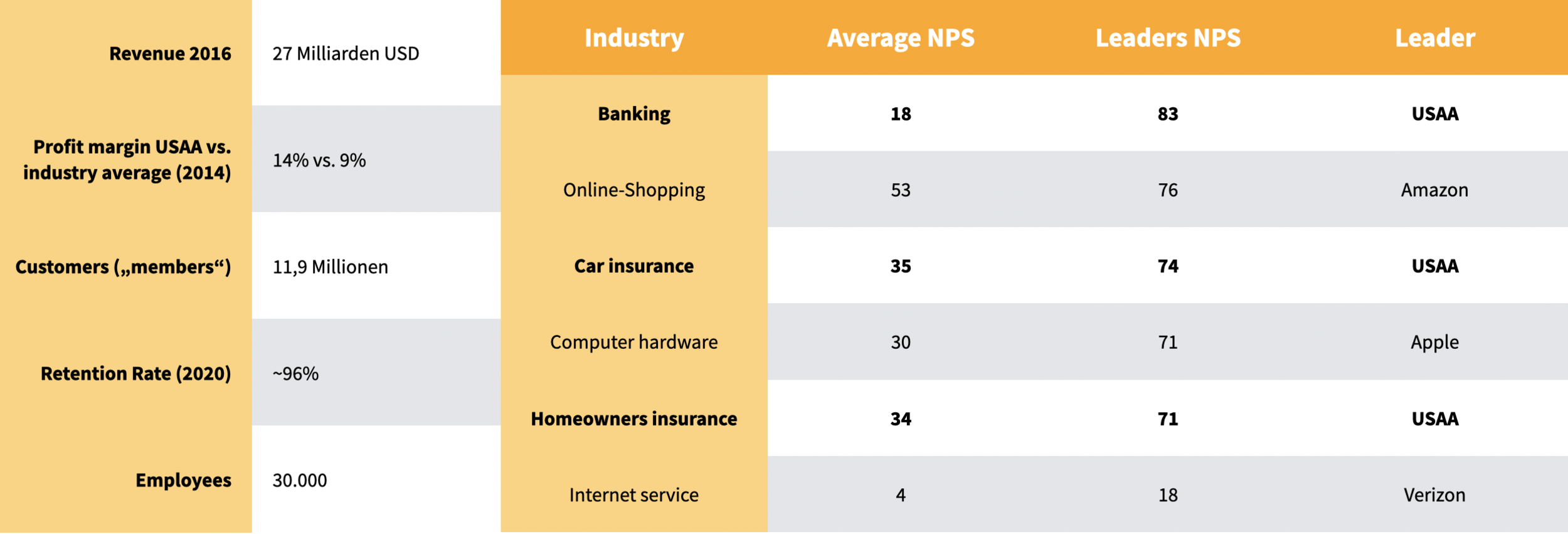

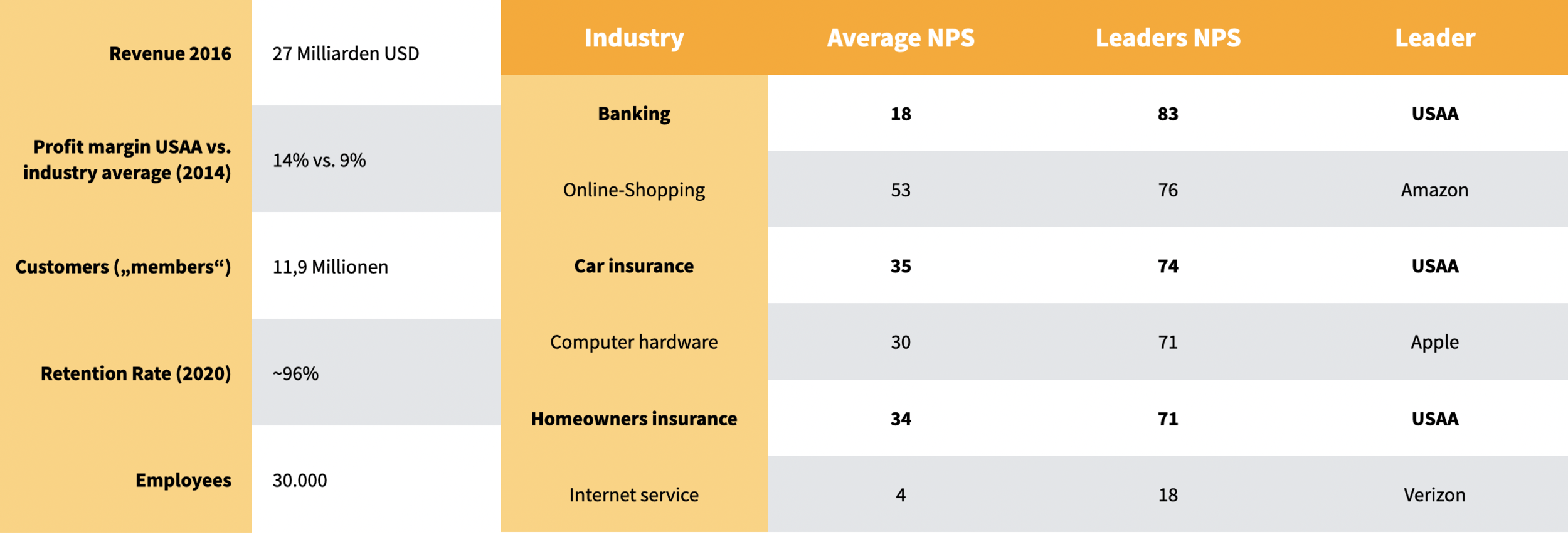

USAA (US Automotive Association, formerly USAAA, US Army Automotive Association) is a US financial services company whose products are primarily in the banking, investment & insurance industry. USAA's target audience is mainly US Army soldiers and their families, who are seen as members, connected through their common professional background. Since its founding in 1922, USAA has been privately owned by its members. In 2015, USAA was named a Customer Experience Champion by KPMG. For good reason. For example, its Net Promoter Score is 400% better than the industry average.

Significant metrics on USAA: financials, customer experience KPIs, and NPS comparison

The award, however, resulted primarily from the decision to change its business model from traditional financial services (car insurance, houseowner insurance, etc.) to so-called life events in order to focus on the needs of the customer. This article describes how USAA managed to create the conceptual basis for this decision, to develop the operational structures necessary for the implementation, to motivate its employees to make this change, to execute the approach and to firmly establish it in the governance and corporate culture.

1. The driving force behind CDXE at USAA

Mission statement of USAA

Customer Centricity at its roots

USAA has been a very customer-centric company since its founding. On the one hand, this is reflected in the fact that USAA itself has no real customers, but only members who are to be helped with various financial decisions. On the other hand, this is even more deeply rooted in the company's philosophy, through which USAA makes it its mission to help its members in the best possible way, as simply as possible, with the highest standards and latest innovations. In addition, the current slogan, "We're ready to serve," suggests that the individual member is already the focus - much like the military serves the country and its citizens, USAA serves its members - while building a trusted bond with its target audience, U.S. Army soldiers and their families. With its core values of service, loyalty, honesty and integrity, USAA also demonstrates that members can count on a long-term partner that shares the same core values as the U.S. Army, and thus directly aligns with members' core values.

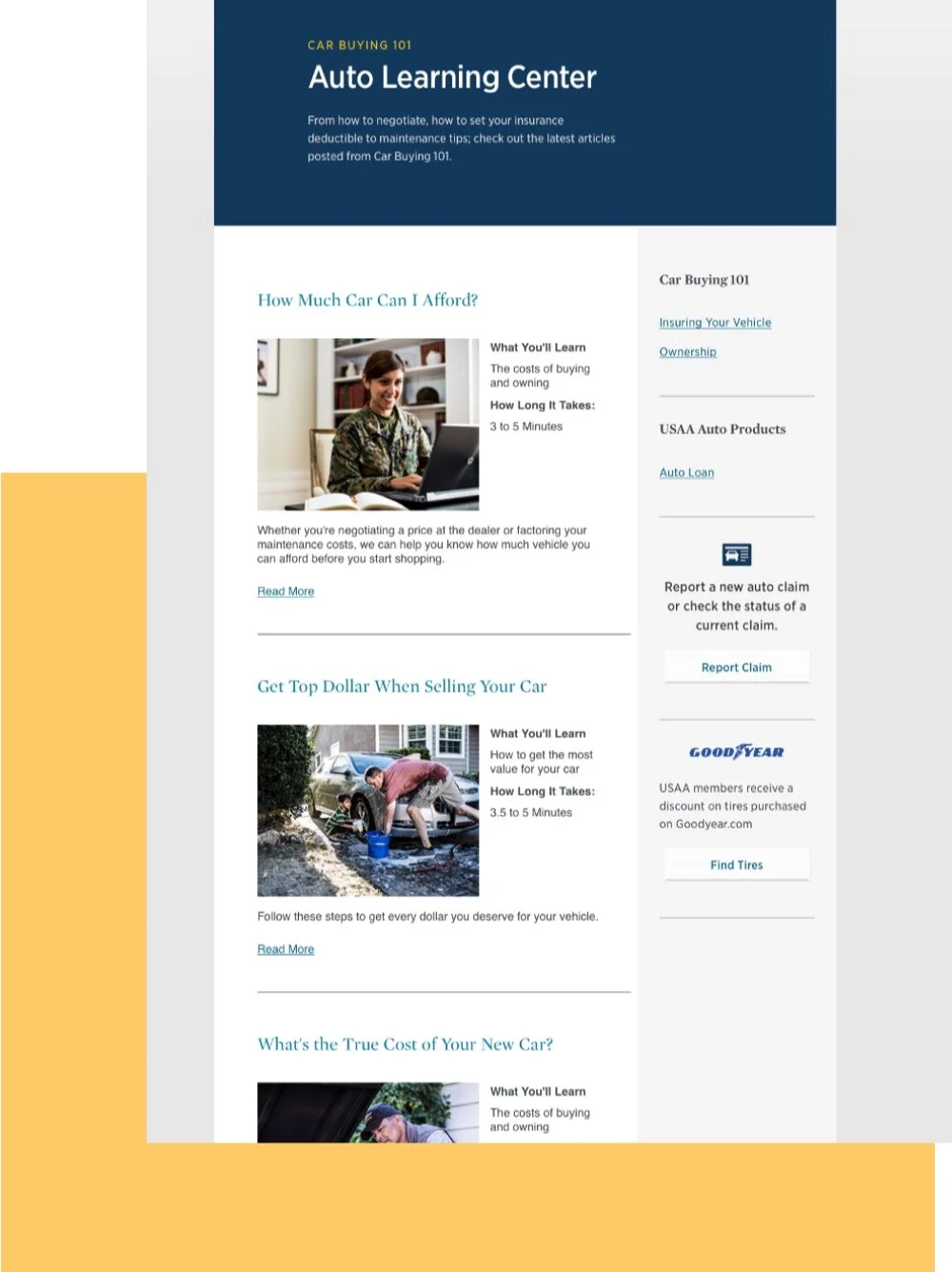

There was still much to improve

Despite the already deeply rooted customer centricity, USAA decided that a good customer experience was not enough to be true to their own principles and company mission. Interaction with members had to be even easier and USAA wanted to give them an even stronger feeling that they could solve their problems quickly and without problems (to get things done). It was noticeable that even though customer centricity was already well established, the individual member still had to go through a very rigid process to solve problems that were actually interconnected. For example, if the member wants to buy a new car, he or she needs a car loan from USAA Bank, insurance from USAA P&C Insurance, and then still has to go to the dealership and decide on a car, as well as engage in the pricing process that follows. It quickly became clear that these processes could be integrated and combined - so-called Life Events were born. Life Events represent major events in the lives of members where USAA can also play a role. A Life Event can be the purchase of a car or real estate, a wedding, starting a family and much more. So it is no longer just about providing excellent service to the members in the individual areas for which they are looking for support, but about understanding them as a whole and supporting them in their complete situation. In this way, excellent customer service becomes an excellent customer experience, which makes it easier for members to interact with USAA. For USAA, this in turn offers opportunities to build even stronger member loyalty and become a partner for all life events.

Left: USAA Advice Section: Information hub for significant Life Events (source: USAA)

Right: USAA Auto Learning Center – All you need to know aroud the Life Event of buying a car (source: USAA)

2. How C/DXE was established at USAA

In order to enforce such a fundamental change in member interaction in a tradition-bound and long-established company, the basic structure of the company must be rethought so that internal departments and processes favor the desired goals (structure follows strategy). For this purpose, USAA took various measures that eventually led in their entirety to Customer Experience Excellence and the desired goals.

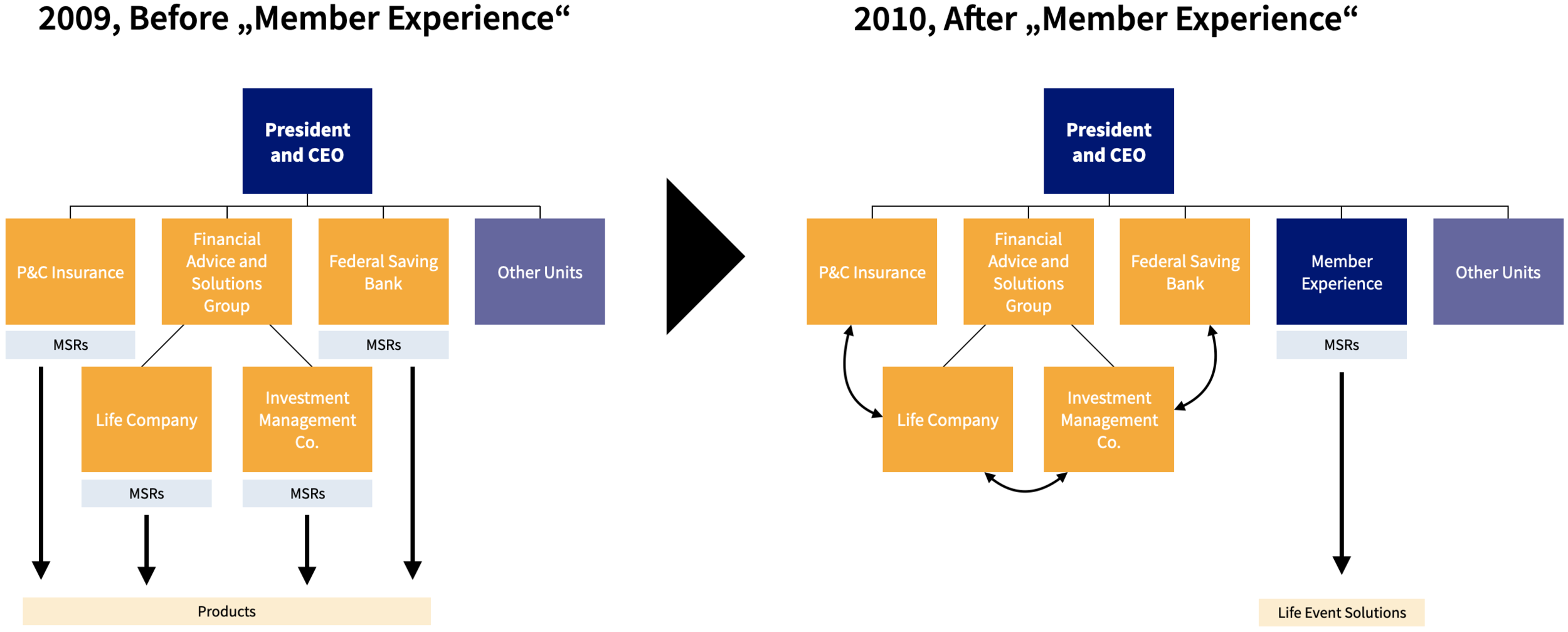

Organizational Changes

First, it became clear that the internal organizational structure needed to be drastically changed to create a structure that would enable solution-driven collaboration between different parts of the business while eliminating silo thinking altogether. While previously there was a very classical structure, separated by product segments, a major decision was made for the restructuring: A new department was created to deal solely with the customer experience and from then on was responsible for all service employees - the Member Experience department was born.

Organizational structure of USAA before and after establishing the Member Experience department (source: Mocker, Ross, Hopkins)

From the beginning, it included 12,000 service employees and its head reported directly to USAA's CEO. The sheer size of this department, as well as the direct reporting to the CEO, directly reflected the importance of creating an integrated customer experience and putting the customer even more at the center within the company from now on. However, this reshuffling not only brought representative benefits internally, but also led externally to the fact that there was now a department that was responsible and also accountable for contact with members. This also meant that the product departments, which were much smaller now, were able to focus dedicatedly on their products and solutions, instead of also being responsible for a product-specific member service at the same time. Simultaneously, new product development was organized across business departments and established through the new Member Experience department, ensuring that integrated products and product experiences were created. This approach resulted in the elimination of divisional egos, as products that benefit only one department but negatively impact the overall experience were no longer offered. This is a clear commitment to USAA's own corporate philosophy that it is solely concerned with helping members in all circumstances to the best of its ability.

Management Changes

Cross-functional council

To do justice to this, it was necessary to develop a governance logic that would enable cross-functional implementation of integrated products and services. With the "Governance Council" which was founded out of this requirement and consists of executives from the individual product departments and the Member Experience, a dedicated platform was created with which individual product components could be integrated across all departments. In the process, it quickly became clear that new roles were also needed, primarily to analyze specific financial advantages & disadvantages of Life Events, such as cross-selling effects or increased overhead costs due to the increased cross-departmental integration effort. Accordingly, a new team was set up in the finance department.

Shifting responsibilities of service staff

However, it was not only the coordination between the departments that posed challenges at the beginning, but also the service staff, who now had to advise members on Life Events instead of individual services. Since the employees had previously been assigned to dedicated product departments, they were often not at all familiar with the other products within their assigned Life Events. The extraordinarily pragmatic solution was a transfer of the previously applicable Life Events offer logic to the service logic - instead of being responsible for different products of a single department, an employee is now only responsible for specific Life Events, but must know all the associated services. This eliminates the mediation game that is often extremely stressful for customers - "You'll have to talk to my colleagues at the homeowner products department about that!"

Remodeling Business Processes

As part of the restructuring and the associated new governance, USAA's internal processes were also put to the test. For this purpose, a business process engineering team was created, which was responsible for reviewing the processes, correcting errors or, in extreme cases, redesigning the entire process. This not only affected internal processes, but also the processes regarding customer interaction which had to be aligned with life events.

Motivating employees

It was precisely because of such far-reaching changes in the working environment of so many people that USAA was confronted with a problem that many companies already have with much smaller measures: How do you manage to keep employees motivated during such serious changes and not lose them in a total blockade attitude? An argumentative anchor here was again and again the corporate philosophy and the basic values of USAA. USAA exists to help its members in the best possible way and it is precisely through these changes that this can be accomplished much better. Another factor was that USAA not only targets soldiers and veterans of the U.S. Army, but also that many of its own employees have a background in the military and can therefore identify very strongly with the company. So it became a matter of personal honor. So much for the emotional arguments. In pecuniary terms, the bonus programs for employees were aligned with the overall success of the company. This strengthened the sense of community and reduced silo thinking.

The importance of IT

Developing the experience for customers

However, all these changes can only make a difference if they reach USAA's members in a tangible way and become touchable - the IT department was largely responsible for this. USAA has replaced its fragmented databases with one central database. This contains all customer data, so that service staff can always call up relevant information from one place and thus provide the best possible service for members along the entire customer journey. In addition, USAA now relies on its own modular and reusable components in all parts of its IT infrastructure - whether for internal applications or even interfaces for members. Although this leads to an increased internal development effort for the respective components, it pays off in the sense that members always receive the same experience, regardless through which touchpoint (web, call center, social media, etc.) they are currently interacting with USAA. At the same time, the relative costs for the development of such components drop rapidly as soon as they can actually be used multiple times in an omni-channel logic.

Last but not least, USAA has recognized that IT architecture is the core enabler of customer and digital experience excellence, along with attitude, governance, and employee commitment. For this reason, the IT department in particular is seen as a driver of new innovations that are intended to keep the digital experience at an excellent level and thus ensure even greater differentiation from the competition in the future.

3. How USAA ensures CDXE in practice

It's one thing to create the conditions for customer and digital experience excellence, but it's quite another to be able to implement them in such a way that customers perceive and appreciate them as a clear advantage.

And this brings us back to the key figures shown at the beginning of the article, which, in addition to monetary effects, also show qualitative KPIs of experience excellence.

Significant metrics on USAA: financials, customer experience KPIs, and NPS comparison

Measuring and weighting KPIs

Here we have, for example, the retention rate (measurement of customer loyalty) or the net promoter score (How likely would you be to recommend this company to others? scale from -100 to 100). USAA's success is also reflected in these very numbers. Retention Rate was nearly 96% in 2019 and regarding the Net Promoter Score, USAA can demonstrate in 2019, for the tenth year in a row, the highest score in the homeowners insurance, auto insurance and Banking categories. While such benchmarks are good to measure the customer experience and also to check the actions taken, the bottom line is that every company is profit driven. When looking at the monetary metrics, it becomes apparent that the focus on customer experience is paying off. In 2010, USAA was still making $17.95 billion in revenue and was able to pull $2.64 billion in net income from that, bringing its net worth to $18.71 billion. In 2019, revenue is $36 billion, the resulting net income is $4 billion, and USAA comes in with a net worth of $36 billion as well. Over the nine-year period, the bottom line is an annual revenue increase of 8.04% (absolute increase of 100%), an annual profit increase of 4.73% (absolute increase of 51.5%), and an annual net worth increase of 7.54% (absolute increase of 92.4%).

Convincing the employees to focus on customer experience

So what is the secret behind this success and how does USAA ensure, beyond controlling it with KPIs, that employees buy into the changes?

Attitude: USAA has made Customer Experience Excellence the central focus of its core values and corporate philosophy. In doing so, the primary goal is to act in the best interest of their customers/members. The commitment to the corporate philosophy and core values not only works for the employees within the company, but can also be felt by the members. Since they have similar core values, this creates mutual bonds and deep trust.

Empathy: USAA tries to understand its members as much as possible in order to be able to act empathically. This starts with the fact that often former soldiers of the US Army or even relatives of soldiers are hired in customer service, continues with the decision that employees are not paid on a commission basis (especially not in the area of customer service) and ends with the fact that attention is not only paid to directly monetary company key figures.

Culture: Sustainable implementation also includes treating employees individually and valuing them so that they are motivated to deliver and further develop CXE for members. The focus here is primarily on customer service employees who are in direct contact with customers. To ensure this, USAA already expanded its home office program for such employees in 2015. In addition, numerous opportunities are offered for further development within the company, whether in one's current job or for completely new tasks.

Dynamic product development: employees also play a central role at USAA when it comes to new products or offers for members. At USAA, the general principle is that every employee is a customer. If he actually is a USAA customer, he can help think about what can be done better or what he himself is missing. If he is a customer of another company and not of USAA, he can bring in what he would still like to see, what he is missing so far and what prevents him from switching. This philosophy is also actively enforced at USAA: Every year, about 10,000 suggestions for new products or offerings are made by the company's own employees. So far, about 1,000 have been good enough to actually be patented. There is, for example, one security employee at USAA who alone has come up with 25 patents that have also been implemented - this testifies to the dedication to the company's own philosophy.

Agile infrastructures: The backbone of many new products and offerings is USAA's IT infrastructure. Not only are the ideas of the company's own employees implemented here, but new technologies are also introduced as quickly as possible in order to be able to offer members something new and better and thus permanently improve their customer experience. For example, shortly after its official launch, USAA introduced Apple Pay, making mobile payments available to its members. Also, since they have been available, biometric authentication methods have been implemented to offer members additional security - so the security of sensitive data is actively taken care of. Another example of customer experience excellence through digital offerings is an app that makes it possible to photograph cars (built in 2000 or later) and get details about the car, nearby offers, as well as financing options and insurance rates.

All of this contributes to USAA's delivery of Customer and Digital Experience Excellence, which is not only based on meeting customer expectations, but also on deliberately exceeding them. However, this only works thanks to the consistent creation of necessary organizational, conceptual and cultural conditions, as well as the motivation and dedication of all employees and managers to fulfill this mission. The tip of the iceberg is then ultimately formed by deep empathic understanding of the needs of the members - both through data as well as through excellent and consciously empathic interpersonal communication.